capital gains tax increase date

The Biden administration proposed that its capital gains tax increase apply to gains required to be recognized after the date of announcement presumably late April 2021 The House proposes that its capital gains increase apply to sales on or after Sept. In fact recent intelligence suggests many Democrats favor a rate increase as low as 42 percentage points which would result in a 242 rate before net investment income NII tax and a 28 rate inclusive of the 38 NII tax.

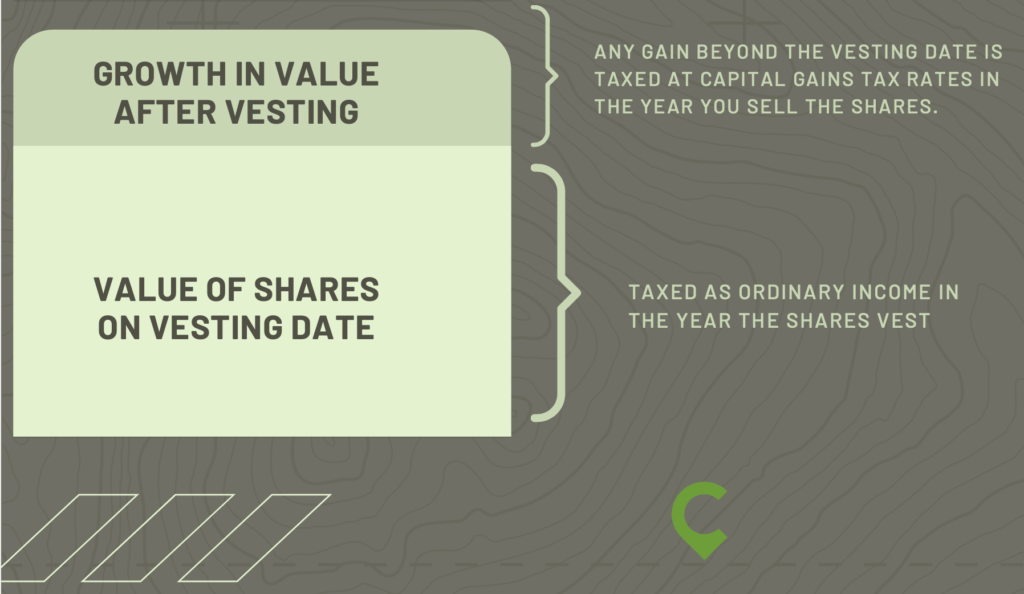

Restricted Stock Units Rsus Explained 4 Tax Strategies For 2022

Capital gains tax CGT is the tax you pay on profits from selling assets such as property.

. President Joe Bidens American Families Plan will likely include a large increase in the top federal tax rate on long-term capital gains and qualified dividends from 238 percent today to 396 percent for higher earners. Understanding Capital Gains and the Biden Tax Plan. It is not a separate tax.

Biden proposed raising the top capital gains tax from 20 to 396 before a joint session of Congress on April 28. Capital gains tax rates on most assets held for a year or less correspond to. If you have a capital gain it will.

This resulted in a 60 increase in the capital gains tax collected in 1986. Long-term capital gains are taxed at lower rates than ordinary income and how much you owe depends on your annual taxable income. If we conservatively use October 15 2021 as the effective date of the tax rate increase any tax-advantaged MSR trade would need to have a sale date of 9302021.

The Canadian federal budget has a release date. Hawaiis capital gains tax rate is 725. Youll owe either 0 15 or 20.

Currently the capital gains rate is 20 for single taxpayers with income over 441451 and for taxpayers who are married filing jointly with income over 496601. Additionally a section 1250 gain the portion of a. This resulted in a 60 increase in the capital gains tax collected in 1986.

In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year. House Democrats on Monday proposed raising the top tax rate on capital gains and qualified dividends to 288 one of several tax reforms aimed at wealthy Americans to help fund a 35 trillion. If your taxable income is less than 80000 some or all of your net gain may even be taxed at 0.

You report capital gains and capital losses in your income tax return and pay tax on your capital gains. Unlike the long-term capital gains tax rate there is no 0 percent rate or 20. June 9 2021 Bernie Kent JD CPA PFS It appears that the White House is planning to make the effective date for its proposed tax increase on long-term capital gains retroactive to April 2021.

If you sell small-business stocks or collectibles the maximum capital gains tax rate is 28. This percentage will generally be less than your income. Some interesting Canadian media commentary about the federal budget and what might be coming can be accessed here.

The proposed effective date is for taxable years beginning after december 31 2021. Although it is referred to as capital gains tax it is part of your income tax. It would be very surprising to see the capital gains rate go higher than 28.

Additionally the change to 25 could be effective. Were going to get rid of the loopholes that allow Americans who make more. From a tax perspective heres a short list of things that our firm will be looking for.

The current estimate of. It was announced today that the budget will be released on the afternoon of April 7 2022. When including the net investment income tax the top federal rate on capital gains would be 434 percent.

Long-Term Capital Gains Taxes. If you sell stocks mutual funds or other capital assets that you held for at least one year any gain from the sale is taxed at either a 0. Additionally the proposal would impose a 3 surtax on modified adjusted gross income over 5000000 effective after December 31 2021.

That applies to both long- and short-term capital gains. In the Tax Reform Act of 1986 enacted October 22 1986 the tax rate on long-term capital gains was increased from 20 in 1986 to 28 in 1987. 13 2021 unless pursuant to a written binding contract effective on or before Sept.

This will affect long-term and short-term capital gains since both would be taxed as ordinary income in the highest bracket. Once fully implemented this would mean an effective federal. The Tax Policy Center found that capital gains realization increased by 60 before the capital gains tax was increased from 20 to 28 by the Tax Reform Act of 1986 effective in 1987.

The current estimate of that effective date ranges from October 15 2021 on the early. The effective date for this increase would be September 13 2021. The proposal would increase the maximum stated capital gain rate from 20 to 25.

The 2021 tax brackets are 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. The maximum rate on long-term capital gains was again. There is currently a bill that if passed would increase the.

As of 2021 the long-term capital gains tax is typically either 0 15 or 20 depending upon your tax bracket. The rates do not stop there. While the proposed increase is not as severe as originally feared the top capital gains tax would see an increase from 20 to 25.

Most likely the actual long-term capital gains tax increase will be agreed to in reconciliation of the infrastructurestimulus bill this coming fall. The capital gains tax on most net gains is no more than 15 for most people. The 1987 capital gains tax collections were slightly below 1985.

Restricted Stock Units Rsus Explained 4 Tax Strategies For 2022

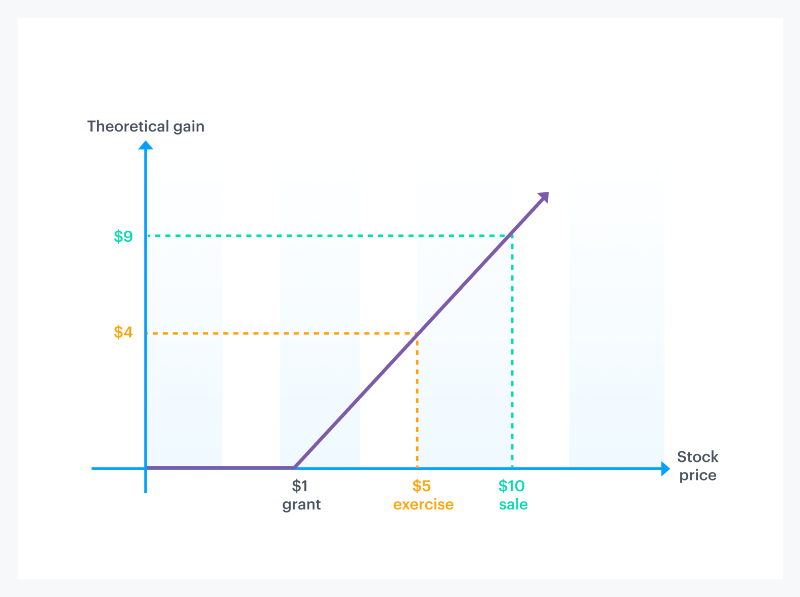

How Stock Options Are Taxed Carta

How To Calculate Capital Gain Tax On Sale Of Land Abc Of Money

Solved Can You Avoid Capital Gains Taxes On A Second Home

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Capital Gains Yield Cgy Formula Calculation Example And Guide

Capital Gains Tax What Is It When Do You Pay It

All About Capital Gain Exemption Under Section 54 Capital Gain Capital Assets Investing

:max_bytes(150000):strip_icc()/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-02-e2a3aeb7d91347578e72df8195d0e8f0.jpg)

Get The Most Out Of Employee Stock Options

Uk Taxation On Shares Example Forex Trading Forex Trading Brokers Forex Trading Training

Taxation In Australia Wikipedia Capital Gains Tax Income Tax Return Payroll Taxes

How Does The Personal Representative Deal With The Income And Capital Gains Arising After The Deceased S Death Low Incomes Tax Reform Group

What Is The Stepped Up Basis And Why Does The Biden Administration Want To Eliminate It

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)